nj 529 contributions tax deductible

Most states limit the amount of annual 529 plan contributions eligible for a state income tax benefit but annual 529. There are 30 states which allow filers to claim a tax deduction for a 529 savings plan contribution and you are correct that New Jersey is not one of them Mott said.

529 Tax Deductions By State 2022 Rules On Tax Benefits

Ad Getting a Child to College Can Be Stressful.

. Visit The Official Edward. Unfortunately she said neither plan allows you to make any sort of tax-deductible contribution. As of January 2019 there are no tax deduction benefits when making a contribution to a 529 plan in New Jersey however you do have the ability to take advantage of up to a 1500 maximum.

36 rows Limits on annual 529 state income tax benefits. Ad Getting a Child to College Can Be Stressful. Minimum subsequent contributions are 25 and less with payroll deduction or the automatic plan.

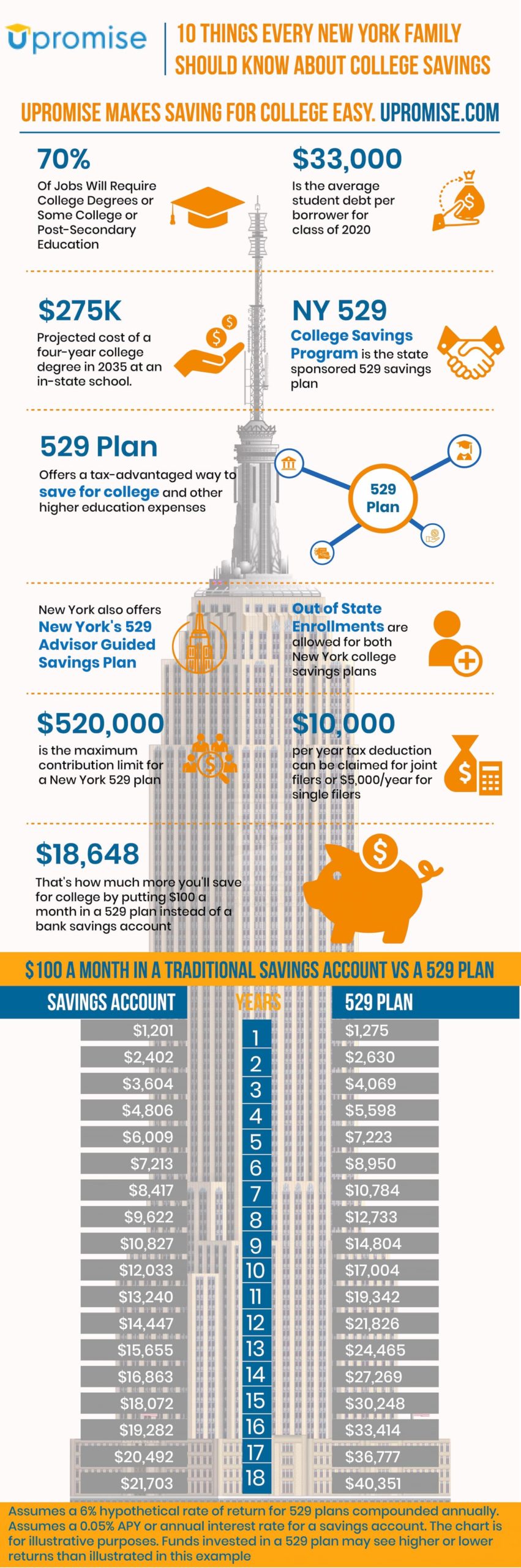

Our Plan Opens More Doors By Making College Affordable. New Jersey taxpayers with a gross income of 200000 or less may qualify for a state income tax deduction for contributions into an NJBEST plan of up to 10000 per taxpayer per year. Ad A 529 Plan Protected Against Rising Tuition Costs.

If your state has no income tax the 529 plan tax deduction doesnt apply. Get Fidelitys Guidance at Every Step. Unfortunately the federal government does not allow families to deduct contributions to a 529 plan.

Your contribution cannot be more than 75 of your annual health plan deductible 65 if you have. NJ residents can claim a tax deduction for contributions to a NJ 529 plan. NJ state tax deduction for contributions into an NJBEST account of up to 10000 per year.

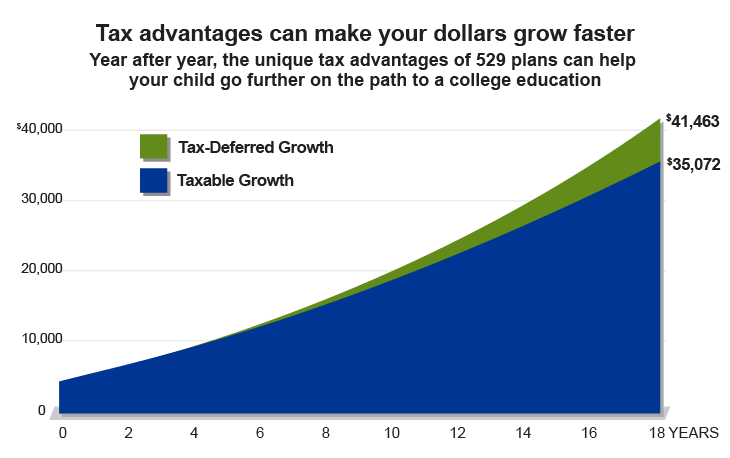

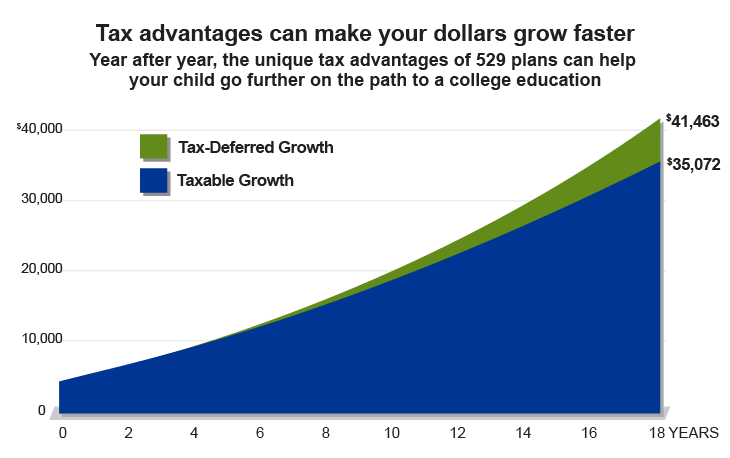

Contributions are deductible in computing state taxable income 529 plan contributions grow tax-free. College savings plans fall under Internal Revenue Code Section 529 Qualified Tuition Programs. Beginning with the 2022 Tax Year the law will allow New Jersey taxpayers to deduct 529 plan contributions of up to 10000 per year from state.

A 529 plan allows you to save for college or higher education while receiving some type of tax benefit. Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan. A 529 plan is an excellent option to start saving for your childs college education early.

Section 529 - Qualified Tuition Plans. There is no indication that this rule will change anytime soon. Currently you can contribute to your New Jersey 529 plan until the.

The proposed state budget includes a new state tax deduction for contributions of up to 10000 into an NJBEST account for families with incomes below 200000 state. New Jersey follows the federal rules for deducting qualified Archer MSA contributions. As of January 2019 there are no tax deduction benefits when making a contribution to a 529 plan in New Jersey however you do have the ability to take advantage of.

529 plan contributions arent typically tax-deductible but they. Earnings from 529 plans are not subject to federal tax and generally not subject to. Unlike many states the IRS does not provide a current tax deduction for.

To your question for both plans - and for other non-New Jersey 529 plans - the. November 30 2021. Get Fidelitys Guidance at Every Step.

Contributions to such plans are not deductible but the money grows tax-free while it. While there are no annual contribution limits for 529 plans most states limit the total amount of contributions that qualify for an income tax credit or deduction. No Fees Many Tax Advantages.

For taxpayers with gross income of 200000 or less beginning with contributions in tax year. A 529 plan is designed to help save for college.

529 Plan Tax Rules By State Invesco Us

How Much Can You Contribute To A 529 Plan In 2022

The Dc College Savings Plan 529 Basics

The Top 9 Benefits Of 529 Plans Savingforcollege Com

How To Choose 529 Plans For Your Child S Education Moneygeek Com

An Alternative To 529 Plan Superfunding

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

States That Offer 529 Plan Tax Deductions Bankrate

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen

529 Tax Benefits By State Invesco Invesco Us

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

10 Things Parents Should Know About College Savings

529 Plan New York Infographic 10 Facts About Ny S 529 To Know

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College